In the United States, car insurance rates can vary dramatically depending on where you live. Your zip code plays a pivotal role in determining how much you’ll pay for coverage, often more than your driving record or the type of car you own. Why? Because insurers use location-based data to assess risk factors like accident rates, theft statistics, and even weather patterns. According to recent data, the national average for full coverage car insurance is around $2,014 per year, but this can swing from as low as $1,200 in some rural areas to over $3,000 in urban hotspots.

If you’re shopping for car insurance or planning a move, understanding how zip codes influence rates is crucial. In this in-depth guide, we’ll break down the factors that affect car insurance premiums by zip code, highlight the cheapest and most expensive areas across the USA, provide real-world examples, and offer practical tips on how to get the best quotes. We’ll also explore state-specific variations and ways to lower your costs, no matter where you reside. By the end, you’ll have a clear roadmap to navigate this complex landscape and potentially save hundreds of dollars annually.

Why Do Car Insurance Rates Vary by Zip Code?

Car insurance isn’t a one-size-fits-all product. Insurers rely on actuarial data to price policies, and your zip code is a key piece of that puzzle. It’s not arbitrary—it’s based on localized risks that make certain areas more prone to claims. Here’s a detailed look at the main factors influencing rates:

1. Population Density and Traffic Congestion

Urban zip codes with high population density often have higher rates due to increased traffic, which leads to more accidents. For instance, in cities like Los Angeles or New York, the sheer volume of vehicles on the road elevates collision risks. Data shows that drivers in densely populated areas pay up to 50% more than those in rural zones. Think about it: A zip code in Manhattan might see thousands of cars per square mile, while a rural Idaho code has open roads and fewer interactions.

2. Crime and Theft Rates

Areas with higher vehicle theft or vandalism rates see inflated premiums. Insurers use FBI crime statistics tied to zip codes to gauge this risk. For example, zip codes in Detroit or Baltimore, known for higher auto theft, can add $500 or more to annual costs. Comprehensive coverage, which protects against theft, becomes pricier in these spots. Conversely, low-crime suburbs like those in Connecticut often enjoy rates under $600 per year.

3. Accident and Claim Frequency

Zip codes with a history of frequent accidents or claims drive up costs. This includes everything from fender-benders to severe crashes. States like Michigan and New York have zip codes where rates double due to high claim volumes. Insurers analyze data from sources like the National Highway Traffic Safety Administration (NHTSA) to pinpoint these high-risk areas.

4. Weather and Natural Disasters

If your zip code is prone to hurricanes, floods, or hailstorms, expect higher rates. Coastal Florida zip codes, for instance, factor in hurricane risks, pushing averages over $2,500. In contrast, milder climates in the Midwest might keep rates stable. Climate change is exacerbating this, with more frequent extreme weather events influencing long-term pricing.

5. Repair and Medical Costs

Local labor and parts costs affect how much insurers pay out for repairs. Zip codes near expensive urban centers have higher medical bills from accidents, leading to elevated premiums. In Los Angeles, for example, the average repair cost is 20% above the national average, directly impacting rates.

6. State Regulations and Laws

Not all states allow zip codes as a rating factor—California, for one, prohibits it to promote fairness. In states that do, like New York or Pennsylvania, the disparity can be stark, with rates varying by over 100% between neighboring zip codes. Other elements like minimum coverage requirements and no-fault laws also play in.

7. Demographic Factors

While not directly tied to you personally, zip code demographics (average age, income, education) influence group risk profiles. Areas with younger drivers or lower credit scores might see higher averages.

These factors combine to create a “risk score” for each zip code, which insurers use to set base rates. Tools like rate maps (though not always public) help visualize this, but you can approximate using online calculators.

ALSO VISIT: US ZIP Code Lookup Tool – Find City, States & Demographic Data Instantly

Average Car Insurance Rates by Zip Code: National Overview

Nationally, full coverage averages $2,014, but zip code variations make this figure misleading. Let’s dive into data from 2025 studies.

Using calculators from sites like CarInsurance.com, the cheapest zip codes are often in rural or low-risk states. For example:

- Cheapest Zip Codes: In Connecticut (e.g., 06001 in Avon), rates can dip below $600 annually for full coverage. Massachusetts (02108 in Boston suburbs) and Idaho (83701 in Boise) follow suit, with averages around $550-$700. Wisconsin’s 54937 (Fond du Lac) and 54703 (Eau Claire) are among the lowest at under $1,000.

- Most Expensive Zip Codes: New York’s 11212 and 11233 in Brooklyn top the list, with rates exceeding $4,000 per year due to high theft and accidents. In Los Angeles, 90010 (Koreatown) averages $3,471, and 90028 (Hollywood) hits $3,433. Other hotspots include Detroit’s urban codes and Miami’s coastal areas.

Here’s a table comparing average full coverage rates in select zip codes (based on 2025 data):

| Zip Code | City/State | Average Annual Rate | Key Reason |

|---|---|---|---|

| 06001 | Avon, CT | $580 | Low crime, rural setting |

| 83701 | Boise, ID | $620 | Mild weather, low density |

| 54937 | Fond du Lac, WI | $950 | Low accident rates |

| 11212 | Brooklyn, NY | $4,200 | High theft and traffic |

| 90010 | Los Angeles, CA | $3,471 | Urban congestion, high repairs |

| 48201 | Detroit, MI | $3,800 | Elevated crime |

Sources indicate that moving just a few miles can save or cost you $1,000+ yearly.

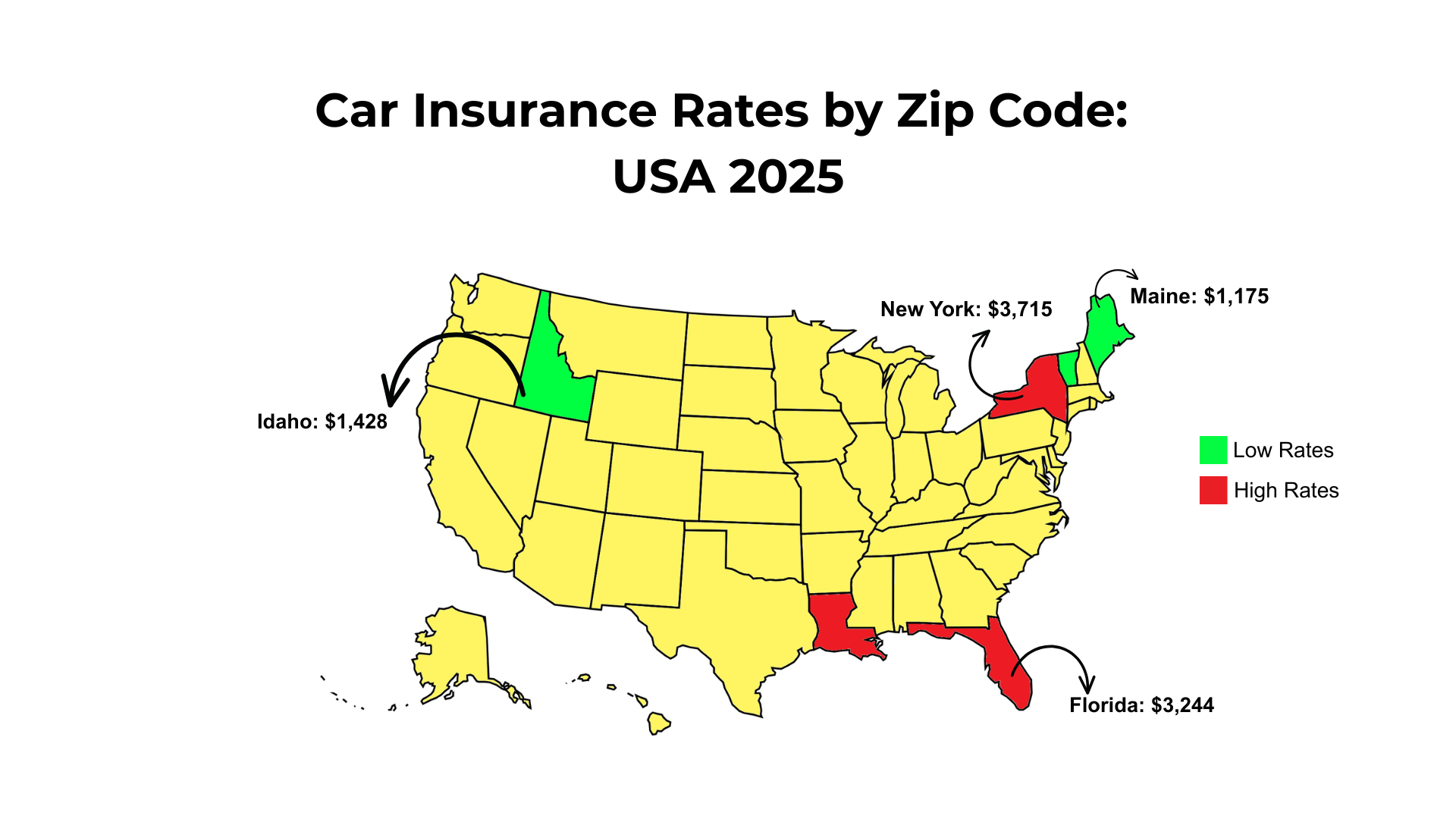

By state, Maine ($1,175), Vermont ($1,319), and Idaho ($1,428) are the cheapest for full coverage, while Louisiana ($2,883), Florida ($3,244), and New York ($3,715) are the priciest. These averages mask zip code disparities—in Florida, a Miami zip might cost $4,000, while a rural one is $2,000.

Cheapest and Most Expensive States and Zip Codes in Detail

Let’s zoom in on extremes.

Cheapest States and Zip Codes

- Vermont and Idaho: These states boast low population density and minimal urban risks. Zip 05401 in Burlington, VT, averages $1,100, thanks to safe roads and low claims.

- Ohio and New Hampshire: Rural zip codes like 43085 in Worthington, OH, keep rates under $1,200.

- Wisconsin Examples: 54703 in Eau Claire offers rates as low as $900, ideal for families seeking affordability.

Most Expensive States and Zip Codes

- Louisiana and Florida: High hurricane risks and no-fault laws inflate costs. Zip 70112 in New Orleans hits $3,500+.

- New York and Michigan: Urban density and high medical costs. Brooklyn’s 11233 averages $4,100.

- California Hotspots: Despite regulations, LA’s 90010 remains pricey due to traffic.

In Maryland, zip code disparities highlight inequities—premiums in high-minority areas can be $1,400 higher than nearby affluent ones.

How to Get Car Insurance Quotes by Zip Code

Getting accurate quotes is straightforward with online tools. Here’s a step-by-step guide:

- Gather Your Info: You’ll need your zip code, driver’s license, vehicle details (make, model, VIN), and driving history.

- Use Comparison Sites: Platforms like The Zebra, Insurify, or NerdWallet let you input your zip code and compare quotes from GEICO, Progressive, Allstate, and more. Enter your zip, answer questions, and get side-by-side rates in minutes.

- Direct Insurer Quotes: Visit sites like Liberty Mutual or Progressive, enter your zip, and get personalized estimates.

- Check for Discounts: Many offer zip-specific deals, like safe neighborhood reductions.

- Avoid Common Pitfalls: Don’t rely on one quote—shop around. Tools like Policygenius provide zip-based averages to benchmark.

Expect quotes as low as $29/month in low-risk zips, but always verify coverage levels.

Tips to Lower Your Car Insurance Rates Regardless of Zip Code

Even in expensive areas, you can save:

- Improve Your Credit: Better scores can cut rates by 20-30%.

- Bundle Policies: Combine auto with home for 10-25% off.

- Choose a Safer Car: Vehicles with high safety ratings lower premiums.

- Drive Less: Low-mileage discounts apply in any zip.

- Shop Annually: Rates change; re-quote every 6-12 months.

- Consider Moving: If feasible, a lower-risk zip can save big.

- Defensive Driving Courses: Many states offer discounts for completion.

In high-cost zips, opt for higher deductibles to balance premiums.

Conclusion: Navigating Zip Code Impacts on Car Insurance

Your zip code is a silent but powerful determinant of car insurance rates, influenced by a web of local risks and regulations. From the affordable havens of Idaho to the pricey streets of New York, understanding these variations empowers you to make informed decisions. Use online tools to compare quotes, factor in potential moves, and apply savings strategies to keep costs down.

Remember, while you can’t change your zip code overnight, shopping smartly can yield immediate savings. For personalized advice, consult an agent or use the resources mentioned. Stay safe on the roads, and drive knowing you’ve got the best deal possible.